Investors’ Negativity Destroys Startups: How to Find Money before Burnout

The first rounds of attracting investments are always accompanied by hard work. Searching for potential beneficiaries and constant negotiations: this takes a lot of time and distracts from the product. In order not to burn out emotionally and find growth points, the startup leader needs to understand how to work even in the face of investor’s negativity.

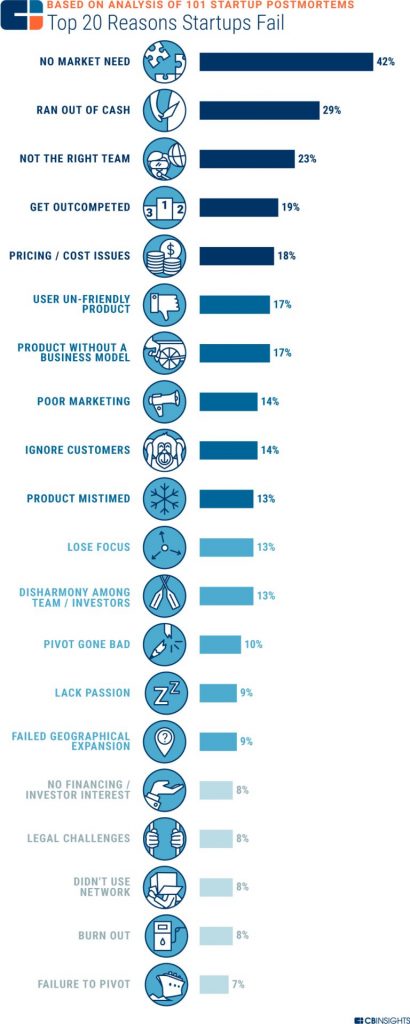

According to data from different years, out of 10 launched technology startups, only 1–2 companies celebrate their third birthday. The reasons for failure lie in the difficulties at the investment attraction stage. According to the CB Insights study, most often a business fails because the consumer didn’t need the product. However, the second most popular reason is “out of money.”

Investment attraction failures are usually dictated by lack of experience, misunderstanding of potential investor target groups, external factors, and sometimes even by chance. Negativity from the people to whom you present your product doesn’t simplify this process. Here are three factors that can help a startup build a negotiation strategy and not burn out in the first seed round:

– Choose investment attraction channels based on the pros and cons of the product.

– Thoughtfully define and unify the negotiation algorithm and strictly adhere to the plan.

– Be proactive and persistent.

Choosing investment attraction strategy

Theory:

Foundations are suspicious of companies with little traction, so you need to go to private investors.

Reality:

At the very beginning, you can long and painful look for major investment from foundations by proving to them that you are worth paying attention to. But a second way is to close the most basic needs with small amounts from private investors. At the start, when your achievements are minor and you have nothing to show to the foundations, it is better to choose the second option. In the first seed rounds, it is worth looking for angels and build upon them the entire investor searching and negotiation strategy. One of the important aspects of working with angels is that foundations work with big checks, while private individuals will be able to provide small contributions necessary for operating expenses.

Tip:

Before contacting investors, make a list of those who could potentially be interested in your product. Identify the most active angels in your target markets, find their Facebook pages and write directly to them. For your reference, Facebook has investor and startup groups. They work as follows: you buy access for a month and have the opportunity to place a pitch desk on your page, which potential investors can see.

Not everyone answers, but you can automate the process

Theory:

Not a single message will be unanswered! It will be immediately clear who is interested and who is not.

Reality:

When you write interminable emails, you expect that communication will be strictly to the point and many respondents will answer at least “yes” or “no”. This is the ideal. In fact, during negotiations you have to deal with very different reactions: one person is silent, but another can bring negativity. Although many still answer: “this is out of my range of interest” or “nothing is clear with this pandemic, so I wait until autumn”.

Tip:

To better focus on searching for investors, you can consolidate all negotiation processes into one task. Just create a table containing investors’ names, email addresses, Facebook accounts, and negotiation status. It is convenient to divide contacts into those from whom a response is expected, those with whom you are actively communicating, and those who haven’t yet invested but are monitoring the company’s performance. During one round at the beginning of the week, go through the list, send information, and remind those who haven’t answered yet of yourself. The list will expand from round to round, but, in general, the procedure is the same.

No activity, no investors

Theory:

Paid access to the angel community on Facebook attracts many potential interested investors.

Reality:

In general, you can find a lot of useful things there, for example, look at the pitch desks of other startups and evaluate what the angels are paying attention to. But the reaction to your post may not be very big or you can receive only a few likes.

Tip:

Even if there were no comments or questions in response to your pitch, you can write a personal message to those who’ve liked your post, for example: “Hi! I’m Alexey. You’ve liked my post. As I understand, you’re interested in it. I can tell you something else if you want.” In the end, one of those who’ve liked your post may turn out to be your investor.

Tip:

The pandemic forced to reconsider the approach to established processes. This also applies to the search for investments. Communicating with investors online is almost the same as face-to-face meetings, but this requires completely different self-presentation skills and preliminary preparation. When compiling a list of angels, you need to find out everything you can about each of them: what their investment portfolio consists of and what markets they work with. All of these things are part of the preparation process and should be considered when you contacting to investors. Remember that sending the same email to everyone on your contact list at once is a bad idea.

Sales funnel

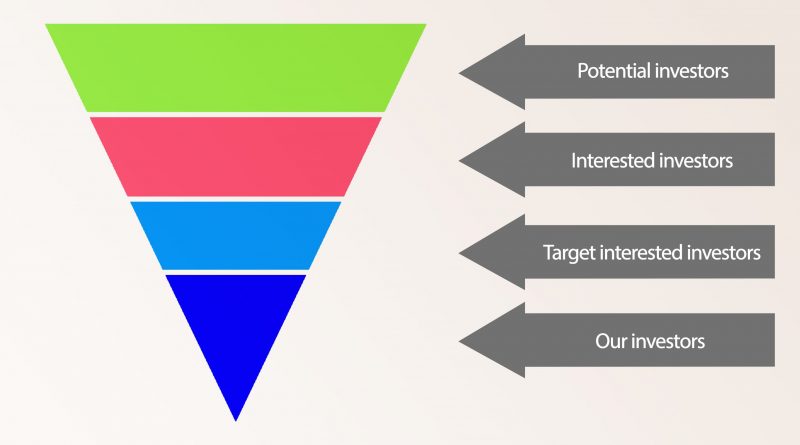

Any negativity and silence from investors are surmountable according to the law of large numbers. The more you write, the more likely you to find an investor. In fact, working with angels is a lot like a sales funnel.

The funnel top is all potentially interested investors. For example, in the first seed round, the list of angels includes about 100 names. These are the private investors you are looking for in the target markets. At this stage, you can send letters containing information about your service and an offer to tell more about it to each person on the list.

Out of these 100 investors, about 40 people will respond to your offer. This is not yet a final list of those with whom negotiations will be held, but at this stage, the funnel narrows, and the circle of angels who invest in a similar product is determined. That is, target investors. Out of 40 angels who responded, about 50% will be target ones. You’re not a fit for other people either due to the size of your business, or they don’t invest in online projects in principle. But with 20 interested target investors, you will regularly communicate with many of them in the future — during all the next rounds.

Finally, the funnel bottom is those who decided to invest. After the first seed round, only one out of 20 people will become an investor.

Conclusions

The main disadvantage of the first rounds of attracting investments is negative feedback from investors and the need for constant emotional and physical involvement, which greatly distracts from the product. As a result, marketing, recruiting, development and other processes that require at least some participation and control can be frozen.

Unfortunately, there are not so many solutions to this problem, since investments are the main locomotive, and everything else pales in their shadow. Nevertheless, timely coordination, adaptive management methods and the use of workflow optimization services (for example, Slack or Trello), can partially ease the manager’s load. Optimization also applies to marketing: business SMM support can be automated using social media cross-posting services, such as Postoplan.